Forget lottery tickets and six-figure salaries – the true path to financial freedom might just be lurking in the clearance aisle. In a world obsessed with consumerism, discount shopping often gets dismissed as cheap or frugal, but the truth is, it’s a superpower in disguise.

Let’s shed the stigma and embrace the empowerment of discount shopping:

- Slashing Debt and Building Wealth: Every bargain you snag is a mini-victory against debt and a step closer to financial independence. Discounts translate to extra savings, which can be used to chip away at loans, build emergency funds, or invest for the future. Picture this: instead of blowing your paycheck on full-priced sneakers, you score a killer deal at the outlet and suddenly have that much more breathing room in your budget.

- Breaking Free from the FOMO Trap: Discount shopping teaches you to value things for what they are, not what they cost. You break free from the fear of missing out (FOMO) and the pressure to keep up with trends. You realize that happiness doesn’t come with a designer price tag, and you start appreciating quality over hype. This shift in mindset not only saves you money, but also liberates you from the hamster wheel of consumerism.

- The Thrill of the Hunt: Let’s face it, there’s an undeniable thrill to finding the perfect score. Whether it’s a vintage treasure at a flea market or a last-minute flash sale on your favorite tech gadget, the satisfaction of scoring a bargain is a rush in itself. This “thrill of the hunt” keeps you motivated to keep searching for deals, adding an element of fun and satisfaction to your financial journey.

- Sustainable Spending for a Happier Planet: Discount shopping aligns beautifully with conscious consumerism. By choosing discounted items, you’re giving pre-loved goods a second life, reducing demand for new production, and minimizing your environmental footprint. This mindful approach to shopping allows you to feel good about your choices and contribute to a more sustainable future.

Remember, discount shopping isn’t about deprivation – it’s about smart choices and conscious spending. Here are some tips to master the art of frugality:

- Plan your purchases: Don’t impulse buy. Make a list and stick to it. Utilize price trackers and comparison websites to find the best deals.

- Embrace second-hand: Thrift stores, consignment shops, and online marketplaces are goldmines for treasures waiting to be discovered.

- Be patient: Wait for sales and seasonal markdowns. Don’t be afraid to negotiate, especially at flea markets and garage sales.

- Get creative: Learn to repair, upcycle, and DIY instead of buying new. Resourcefulness is your biggest asset.

Ultimately, discount shopping is a journey of self-discovery and empowerment. It allows you to take control of your finances, break free from societal pressures, and build a life that prioritizes values and experiences over fleeting trends. So, grab your reusable tote bag, hone your bargain-hunting skills, and get ready to unlock the financial freedom that lies within the world of discounts. Remember, true wealth isn’t about how much you spend, but how much you can save and enjoy while living a life you love.

Happy shopping (and saving)!

Other Articles

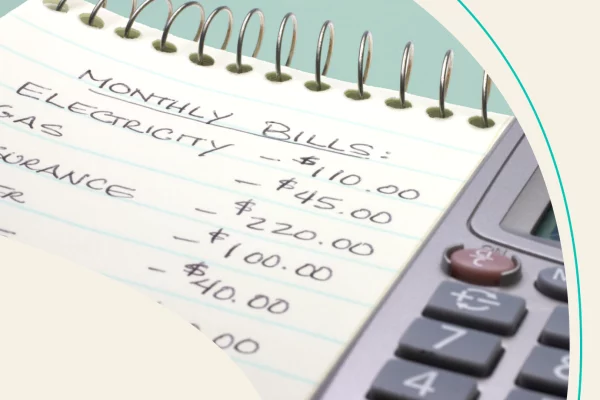

A budget is a plan for how you will spend your money. It can help you track your spending, save for your goals, and avoid debt. If you’re not sure where your money is going each month, a budget can help you get a better understanding of your finances. When your bills feel like they…

Read more

Ah, the allure of instant gratification! That shiny gadget, the luxurious vacation, the trendy outfit… they all sing sweet songs, threatening to derail your meticulously planned financial journey. But fear not, intrepid sailor! With the right tools and a determined spirit, you can resist the sirens of financial temptation and chart a course towards a…

Read more

The holidays are here, bringing twinkling lights, festive feasts, and… potentially, overwhelming financial worries. It’s easy to get swept up in the spirit of giving and splurge on gifts, decorations, and travel, leaving a mountain of debt in our wake. But fear not, budget-conscious celebrators! With a little planning and mindful spending, you can enjoy…

Read more

Ready to Get Started?

Contact me today to get your financial wellness in check! It’s easy to reach out and schedule your intro to financial wellness, just choose an option below!