In a world obsessed with “keeping up with the Joneses,” indulging in luxury and quality feels like a one-way ticket to financial ruin, right? Not so fast! While reckless spending has no place in a healthy financial life, strategically embracing sales and discounts on luxury goods can actually be a powerful tool for enhancing your overall financial wellness. Think of it as smart luxury for the financially savvy.

Here’s how embracing sales and discounts on quality goods can actually benefit your financial health:

1. Access High-Value Goods While Staying on Budget:

Let’s face it, quality and craftsmanship come at a premium. But you don’t have to pay full price to enjoy them. By waiting for sales, clearance events, or even second-hand markets for pre-loved luxury items, you can access those coveted pieces without breaking the bank. This allows you to experience the joy of ownership without sacrificing your long-term financial goals.

2. Increase the Longevity of Your Wardrobe: Luxury goods are often built to last. They’re made with higher-quality materials and construction, resulting in pieces that can become cherished staples in your wardrobe for years to come. Investing in a timeless designer bag during a sale, for example, can replace several cheaper, trendier bags that would quickly fall apart and cost you more in the long run. This kind of strategic buying promotes sustainability and reduces wasteful spending.

3. Build Financial Confidence: There’s a certain empowering feeling that comes with snagging a great deal on a coveted item. It demonstrates your resourcefulness and financial discipline, reminding you that you can indulge in your desires without neglecting your financial goals. This confidence can spill over into other areas of your life, motivating you to make even smarter financial decisions.

4. Combat Impulse Purchases: Waiting for sales or deals before making luxury purchases forces you to slow down and avoid impulsive buys. This gives you time to truly assess whether the item aligns with your needs and style, preventing buyer’s remorse and unnecessary spending. Additionally, the thrill of the hunt that comes with finding a bargain can replace the temporary satisfaction of an impulsive purchase, promoting a more mindful approach to consumption.

Of course, embracing sales and discounts comes with its own set of challenges. Here are some tips to navigate the world of bargains responsibly:

- Set a budget and stick to it: Don’t let the excitement of a sale lead you to overspend. Always have a specific amount in mind and walk away if the price isn’t right.

- Focus on quality over quantity: Prioritize timeless pieces that will last and complement your existing wardrobe instead of getting swept up in fleeting trends.

- Research and compare prices: Do your homework before a purchase. Look for the best deals across different retailers and platforms to ensure you’re getting the most out of your money.

- Avoid impulse buys: Give yourself time to think before hitting that purchase button. Sleep on it, discuss it with a friend, and see if the desire persists.

Ultimately, embracing sales and discounts on quality and luxury goods is about making conscious choices to enhance your life experience while staying financially responsible. It’s about flipping the script on the traditional narrative of luxury being incompatible with financial wellness. By being strategic, informed, and intentional, you can turn this unexpected ally into a powerful tool for building a life filled with both quality and financial security.

Remember, true luxury lies not in the price tag, but in the satisfaction and fulfillment you derive from your purchases. Happy bargain hunting!

Other Articles

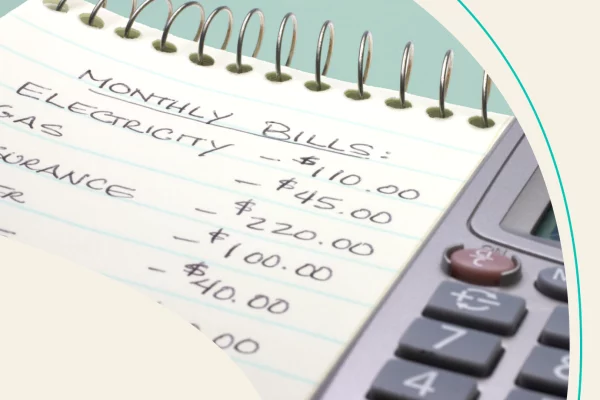

A budget is a plan for how you will spend your money. It can help you track your spending, save for your goals, and avoid debt. If you’re not sure where your money is going each month, a budget can help you get a better understanding of your finances. When your bills feel like they…

Read more

Debt. It’s a four-letter word that should send shivers down anyone’s spine. Whether it’s student loans, credit card bills, or a looming mortgage, debt can feel like a weight on your shoulders, a constant reminder of financial limitations and lost freedom. But fear not, fellow shackled souls! Today, we’re declaring war on debt, exploring the…

Read more

The holidays are a time for joy, family, and… financial stress? It’s true, the festive season can wreak havoc on your bank account if you’re not careful. But fear not, budget-conscious Grinches! With a little planning and some smart strategies, you can celebrate the holidays without breaking the bank (and avoid any Scrooge-like tendencies). Here’s…

Read more

Ready to Get Started?

Contact me today to get your financial wellness in check! It’s easy to reach out and schedule your intro to financial wellness, just choose an option below!