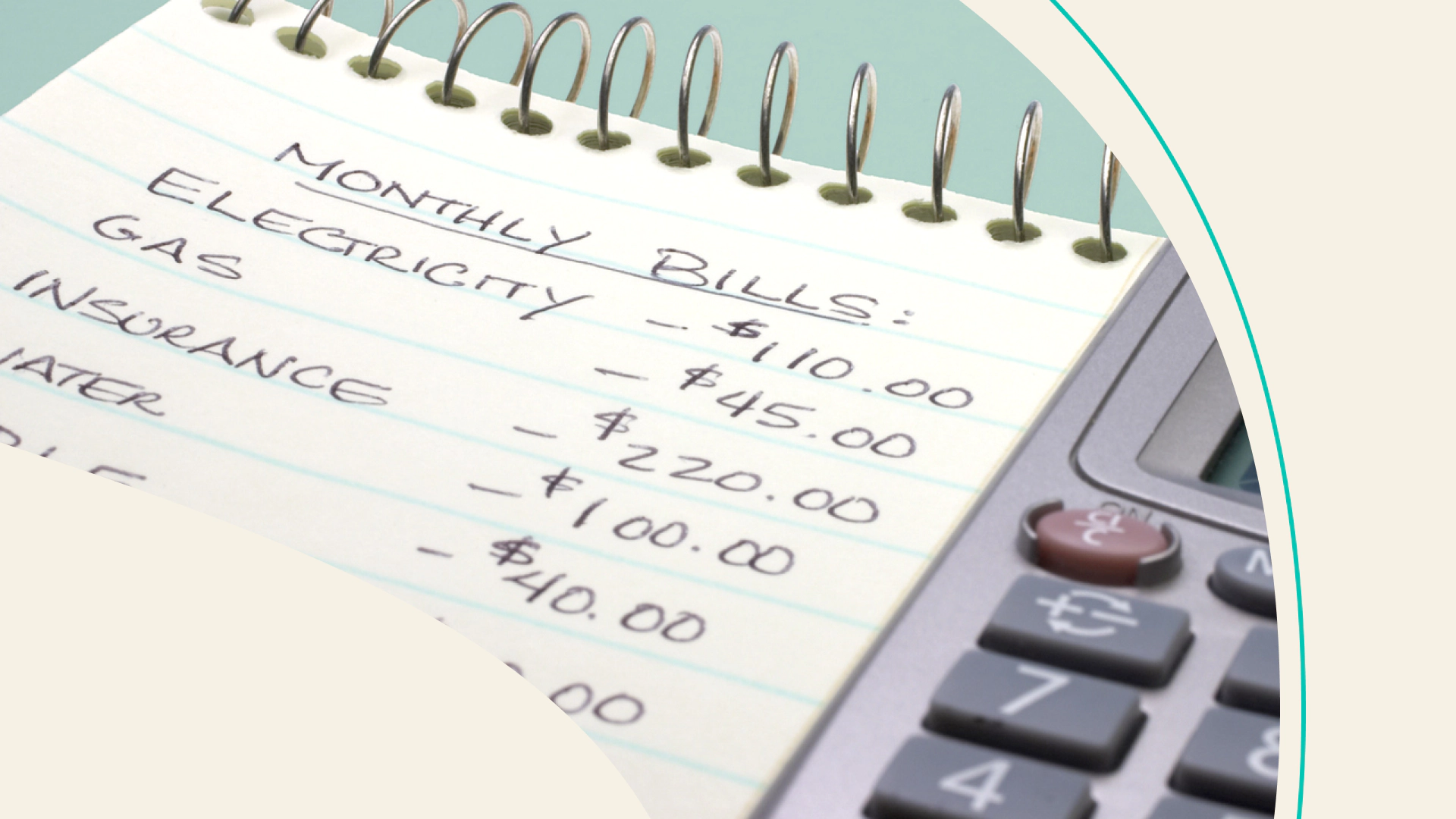

A budget is a plan for how you will spend your money. It can help you track your spending, save for your goals, and avoid debt. If you’re not sure where your money is going each month, a budget can help you get a better understanding of your finances. When your bills feel like they control you and your decisions the budget lets you take control back.

Here are some of the benefits of having a financial wellness budget:

- You’ll know where your money is going. A budget can help you track your spending and see where your money is going each month. This can help you identify areas where you can cut back or save more money.

- You’ll be less likely to overspend. When you have a budget, you’ll have a clear plan for how much money you can spend each month. This can help you avoid overspending and racking up debt.

- You’ll be able to save for your goals. A budget can help you set aside money each month for your goals, such as saving for a car or down payment on a house, retirement, or a child’s education.

- You’ll feel more in control of your finances. When you have a budget, you’ll have a better understanding of your finances and feel more in control of your money. A new feeling of less stress can start to happen and a sense of less anxiety can let you feel more present and peaceful in your daily life.

If you’re not sure how to start a budget, we have free templates on our website; Shanes Financial Wellness. Or you can sign up to work directly with Shane – a trained and certified financial coach. We want you to succeed, our website has budget templates with directions for you and available coaches. Use our scheduling tool to book your free coaching consultation.

Creating your budget takes time and effort, but it really is worth it in the long run. A budget can help you improve your financial health and achieve your financial goals.

It is actually very simple to create a budget. Download our available Budgeting Tools – (Zero Based Budgeting & Allocated Spending Plan) that come with simple easy to follow step by step guides for your budget.

Put the effort in with following the simple step by step directions for your budget and practice making it a habit to follow your budget. Remember it takes time to make a habit stick. So keep up the budget practice and set up a free consultation to have our certified Financial Coach help coach you and your family through this wonderful life changing experience.

Contact me today!

Other Articles

Living Your Dreams: Owning Your Finances vs. Debts Owning You Imagine two roads diverging in the financial forest. One path leads to freedom, security, and a life aligned with your dreams. The other? A constant struggle, stress, and limitations dictated by debt. This is the stark difference between living on your own financial terms and…

Read more

In a world where Gucci slides cost more than a used car and avocado toast is practically a mortgage payment, achieving financial wellness can feel like scaling Mount Everest in flip-flops. But fear not, budget warriors! Discount shopping isn’t just for bargain hunters anymore – it’s a superpower that can transform you from a stressed-out…

Read more

In a world obsessed with “keeping up with the Joneses,” indulging in luxury and quality feels like a one-way ticket to financial ruin, right? Not so fast! While reckless spending has no place in a healthy financial life, strategically embracing sales and discounts on luxury goods can actually be a powerful tool for enhancing your…

Read more

Ready to Get Started?

Contact me today to get your financial wellness in check! It’s easy to reach out and schedule your intro to financial wellness, just choose an option below!